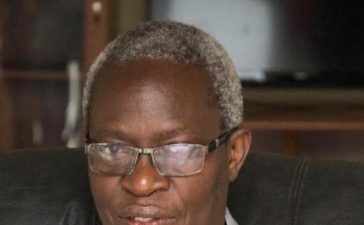

The Attorney General, Thabo Chakaka Nyirenda, has left the FDH Bank disappointed and gnashing after rejecting its application for sovereign guarantee.

According to a letter seen by Shire Times, the FDH bank had, on 5th October 2022, written the Government through the Ministry of Finance demanding a renewal of sovereign guarantee which Malawi Government issued in favour of SF International.

Economic experts working in the Ministry of Finance, but have opted for anonymity, have explained to Shire Times that “a sovereign guarantee is a legal guarantee from government to adopt obligations of a state-owned entity should it default or fall short of meeting its obligations in a contract entered with a foreign company”.

“In this case”, the expert narrated, “the FDH bank entered into a contract agreement with SF International and Government acted as a backup should there be any default. This Government guarantee primarily helped the bank to secure the business contract with the foreign company (SF International) in the first place”, they said.

Shire Times has learnt that the FDH bank, despite being a private entity, secured the Government guarantee during the Democratic Progressive Party (DPP) rule when it customary for the party’s affiliated individuals and entities to find unmerited favors from the Government system which was highly compromised.

In the Government’s reply letter dated 15th December, 2022, the Attorney General informed the FDH Bank that its sought sovereign guarantee renewal had been rejected, pointing out that the initial guarantee that was given was so issued irregularly.

“Sovereign guarantees can be issued only in the public interest according to Public Finance Management Act” pointing out that “no public interest would be served if the guarantee that the Government issued to SF International is extended”.

While in its letter written by Head of Legal and Company Secretary, the bank threatened legal proceedings should Government decide not to extend the guarantee, the Attorney General, in his letter, censured the bank’s sense of misplaced and unqualified entitlement advising that Government cannot extend the said guarantee as “it would unnecessarily increase Malawi’s debt position” further adding that “there is no obligation on the part of Malawi Government to extend the sovereign guarantee which it issued”.

In a warm up battle that was fought in the letters between the bank and the Government, the Attorney General unleashed sword-sharp attack on SF International accusing it of being a money launderer.

“SF International has been involved in a series of procurement malpractices. SF International has also been involved in illegal externalization of foreign currency using FDH Bank Limited, something that you fully know”, said the letter from the Attorney General Chambers.

Despites these publicly-known allegations against SF International, FDH Bank continues to do business with the company as well as pushing for its sovereign guarantee interests, something that raises suspicions that the bank is knowingly acting a conduit of money laundering.

Unfazed with the legal battle threats that the bank’s legal personnel issued, the Attorney General has dared the bank to the legal fight.

“In your letter, you warned that legal proceedings would be commenced against Government should the Government fail to extend the sovereign guarantee in favour of SF International Limited. I would like to advise that you may proceed with commencing the said legal proceedings but please be further advised that we will vehemently defend the same”, the Government said.

“We would also be compelled to mount a counter claim against you over sum of money that you owe Government of Malawi, part of which is contained in a letter of demand by the Director of public prosecutions in which he claimed payment of MK10.6 billion from you,” reads the letter in conclusion.

Meanwhile, four months after receiving the reply letter from the Government, the FDH Bank has remained mute on the matter as there is no any indications of legal proceedings being commenced against the Government.

Efforts to speak to the Attorney General to inquire on whether the Government will proceed with the counter-claim of the MK10.6 billion from FDH or whether the claim is dependent on the bank mounting a legal battle in court, have proved futile as a questionnaire sent to the AG Chambers was not yet attended to by the time of publishing this item.