As of yesterday, 9th August 2023, economic headlines in Kenya were reflecting on their local currency weakened performance against the United States Dollar. “Kenyan Shilling suffers one of its steepest declines in history” read one headline carrying a story of the Kenyan Shilling losing 50% of its value 4 years’ period since 2019.

The story was no different in the Africa’s giant economy – Nigeria – where it was reported by Punch Newspaper yesterday that the recent “devaluation of the Naira would boost Government revenue by N713 billion”.

The Business Insider – Africa, reported three months ago on Tanzania, saying the country is risking more economic hardships as the Shilling was hitting an all-time-law against the United States Dollar.

Malawi’s neighbor to the West, Zambia has not been spared as reports indicate that the Zambian Kwacha has declined with over 20% in its value against the Dollar in 2023, making it among the worst performing currencies in the world.

Malawi has just experienced a similar hit with devaluation of 44% announced yesterday. Whilst its inevitable negative impact will be felt across the domain, a silver lining has been highlighted by government and private-sector economic experts who say the economy now stands to benefit stabilized import capacity of strategic products as well as upgrading the country’s import returns.

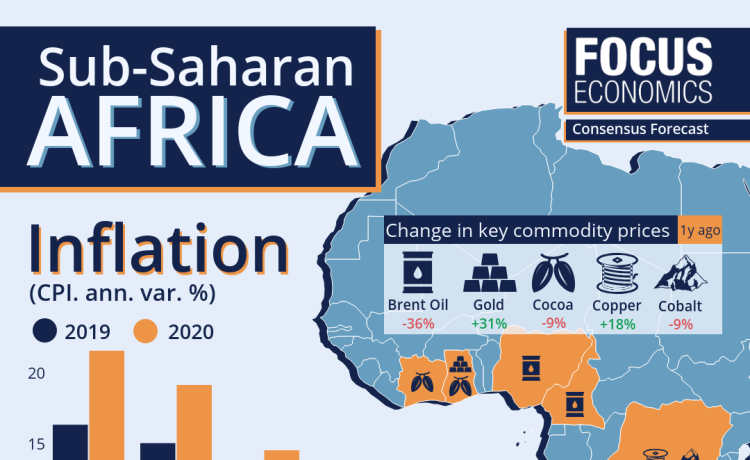

Reflecting on this downward journey of currencies across Africa, the Economic Intelligence Unit has stated that global economies are currently being hit by inflation, specifying that annual inflation of Sub-Saharan Africa, where Malawi, Tanzania, Zambia, South Africa, Zimbabwe and several other countries in the southern belt belong would be facing highest inflation.