“Chickens have come home to roost”: is an idiom that means the consequences of past actions are coming back to haunt someone. It’s often used to describe when someone is facing the consequences of their actions, even if they happened a long time ago.

Government instituted a forensic audit at the Salima Sugar Company following reports that the company was used as a cash-cow by the purported investors from India in corroboration with local public officials.

The audit focused on equity contribution, loan and other facilities as well as resource management and utilization another other aspects.

The findings were enraging: the report revealed that over $30 million (about K51 billion then) was abused at the Salima Sugar Company Limited (SSCL).

Addressing a press conference in Lilongwe on 5th December 2023, the Attorney General, Thabo Chakaka Nyirenda, vowed to fight tooth and nail to recover the loot through civil litigations, while indicating that Government departments that deal with criminal matters would also do their job.

The revelations contained in the audit report about illicit financial activities involving politicians, public servants and others parading as foreign investors, sparked criminal investigations which have culminated into deeper revelations of the actual amounts of money looted and laundered from the public company.

Among other findings of the 2023 report, SSCL was dealing with suspicious companies incorporated in foreign countries, in particular India, Seychelles, South Africa and United Arab Emirates Free-Zone Area. Further, a purported Indian investor incorporated the SSCL in Dubai without the knowledge of the Government of Malawi and a bank account in the name of SSCL was opened in that country which was used to receive foreign loan agreements without Government of Malawi approvals.

It was further revealed that Mr Shirieesh Betgiri, a purported foreign investor from India, opened bank accounts with FDH Bank, First Capital Bank and My bucks without board approval, making himself and his son, Bruhat Betgiri, as the only signatories.

Investigators, prosecutors and other experts were deployed to investigate and uncover every instance of corruption and financial wrongdoing perpetrated by the suspected looting scheme.

The criminal investigations have resulted into an even more chilling revelation: A total of US$635 million (about K1.07 Trillion) was looted.

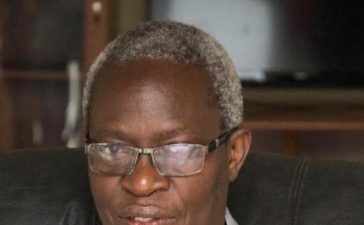

The culprits have been pin-pointed, which include 5 Malawians namely: Joseph Mwanamveka; Lloyd Mhura; Collins Magalasi; Henrie Njoloma; and Goodall Gondwe (Deceased) and 8 Indians which include: Shirieesh Betgiri; Prasad Jadhav; Satish Tembey; Chandrashekhor Ogale; Millind Ulagadde; Sachin Nikam; Dhiraj Nikam; and Prashant Sharma.

The gang has been collectively charged with eight (8) counts which include Conspiracy to use public office for advantage; Conspiracy to Expend Public Money without Appropriation; Conspiracy to Obtain Government Lending without Authority of National Assembly; Conspiracy to Obtain Government Guarantee without prior Authority of Cabinet; Making Misleading Statements; Fraudulent Trading; and Money Laundering.

Charges have been filed against Joseph Mwanamvekha, former Minister of Finance, Lloyd Muhara, former Secretary to the President and Cabinet, and other notable figures, including eight (8) Indian nationals, in connection with alleged conspiratorial activities that have resulted in the misuse of public funds at Salima Sugar Company Limited (SSCL) totaling an eye-watering US$274.5 million.

The charges, filed under the Corrupt Practices Act and other laws, allege that Mwanamvekha, Muhara, Magalasi and an extensive list of accomplices who were purported investors from Indian conspired between 2011 and 2020 to exploit public office for personal gain. Key Indian figures in this alleged conspiracy include Shirieesh Betgiri; Chandrashekhor Ogale, Millind Ulagadde; Prasad Jadhav; Satish Tembey; Sachin Nikam, Dhiraj Nikam; Prashant Sharma.

The arrested Joseph Mwanamveka and three other Malawians including Lloyd Mhura, Collins Magalasi, Henrie Njoloma, and Goodall Gondwe (Deceased) reportedly misused their positions within the Office of the President and Cabinet, the Ministry of Finance, and various government entities to divert vast sums of money into personal and private business interests.

The allegations detail a series of abuses, including the approval of government guarantees and loans totaling hundreds of millions of dollars without the mandatory legal procedures. Notably, charges include expending US$180.1 million without parliamentary approval and conspiring to secure unauthorized guarantees for loans to Salima Sugar Company Limited, amounting to US$118 million.

In what appears to be a sophisticated operation of corruption, the accused are said to have issued misleading statements and fraudulent paperwork to facilitate the illicit transactions. The charges involve making misleading statements to obtain loans, as well as fraudulent trading practices aimed at defrauding the government.

As this multi-faceted case unfolds, authorities are focused on prosecuting not only the principal accused but also the broader network of individuals and companies alleged to have conspired in these high-stakes fraudulent activities. Among these are several corporate entities such as MDE Farms Limited, Ogale Group of Companies, and AUM Sugar and Allied Limited, which are also facing scrutiny regarding their involvement.

Government officials have emphasized their commitment to fighting corruption and ensuring that all individuals involved will face justice.