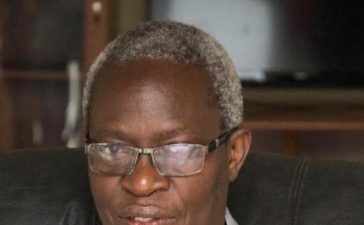

Finance Minister Simplex Chithyola-Banda has delivered a comprehensive and decisive response to the concerns raised by Eric Meyer, the US Department of Treasury’s Deputy Assistant Secretary for Africa and the Middle East. Acknowledging the gravity of Meyer’s observations, Chithyola-Banda outlined a robust plan to tackle the issues head-on. He detailed strategies for enhancing revenue collection at the Malawi Revenue Authority (MRA), curbing the ballooning public expenditures, and advancing critical debt restructuring efforts.

Meyer told the local media yesterday that the US government is worried about Malawi’s failure to deliver on commitments necessary to unlock second tranche of IMF funding and keep the country on the path of economic recovery. Meyer noted that there have been delays by Malawian authorities in reaching an agreement on necessary debt restructuring with some of Malawi’s international creditors and also ballooning of the expenditures. These and many others, according to Meyer, has been further complicated by deals that Malawi is pursuing with some investors that could undermine Malawi’s agreements with the IMF and bilateral creditors.

Below is the detailed response on how the Minister intends to resolve the identified issues.

- ON UNDER COLLECTION BY MRA

We understand that there is under collection at MRA which is affecting the implementing of the program. As a ready measure, Malawi government has just appointed the commissioner general who is going to facilitate for the collection of the same, but we need to also understand that the business environment in this country is contributing towards under collection.

- ON BALLOONING OF EXPENDITURE

The issues about ballooning expenditure are real but also justifiable in the sense that as in the government we need to meet the social obligation. We need to procure fuel in this country, if the county runs dry that will be a very big challenge. We need to also procure medical supplies in this country, if you look at some of the expenditures those are falling under social obligations that we cannot do without.

- ON FOREX MANAGEMENT

We reducing the forex expenditure but also at the same time building our forex reserves that is a positive progress that we’ve made.

- ON DEBT RESTRUCTURING

In terms of debt structure, we are just we are just landing in this country today from Indian where we met the Indian bank discussing the very issues of debt structure. In the week to come we will be heading to China to discuss with the China banks on the same issues. Remember, we are also engaging other creditors for us to reach an agreement in terms of debt restructuring that we are progressing well.

- ON INVESTMENT THAT WOULD CONFLICT ECF PROGRAMME

The issues about investments that cause a challenge to implementation of this years’ programme. Please remember that of the investments are not liabilities; they are investments that are potentially aiming at generating forex into this country through value addition but also increased exports, so we believed that if we are to do all this in the weeks to come we will be able to successfully to pass through this first reviews that are scheduled to be done in September.

- 6. ON LEGISLATIVE POLICIES

I would like to also make mention that some of the issues and conditions required intervention of the National Assembly. The Parliament will be meeting starting from Monday and those issues that are touching on pieces of legislation that will be brought before Parliament for debate and also agreeing on how best we can move forward.

- CONCLUSION

So we are very optimistic as government that will remain on track and that come September we will successfully implement the ECF program